Was chi a ponzi ?

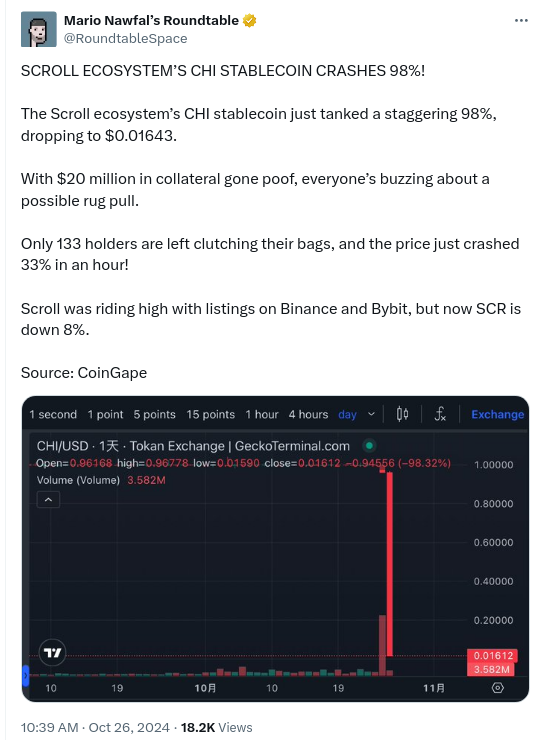

Just 18 days ago I asked if chi is a ponzi?. Today we seem to have gotten an answer:

Just 18 days ago I asked if chi is a ponzi?. Today we seem to have gotten an answer:

A while ago on some random place, someone mentioned chi as being a great way to make money. Obviously things that are recommended on random places tend to be great ways to loose money. But somehow it made me curious in what way exactly, so i made a note. And a few weeks later i actually found some time to look around what chi is. I will in this text omit several links as i dont want to drive anyone by mistake to it and also nothing here is investment advice. And also i have no position in chi for the record, obviously.

Chi is a stable coin on the scroll blockchain. It initially was apparently backed by USDC.

This stable coin is mainly tradable on the tokan decentralized exchange. That exchange has a governance token called

TKN and chi has a governance token called ZEN.

Tokan exchange works like many DEXes, people provide liquidity and get payed in the exchanges governance token TKN for that.

Others can then use that liquidity and pay fees to trade. So the value of TKN is key to how much

rewards liquidity providers receive. The biggest LP pair is USDC/CHI with 58M US$ value paying over 66% annualized interest. These numbers of course change every minute.

Now normally these DEXes have rapidly droping interest rates and their governance token drops in value as they use up any funding they have. And then normalize on some low interest rate based on fees that traders pay. But this one here is different, if you lookup TKN, as of today its price goes up exponentially, that shouldnt be.

It comes from chi being minted and used to buy TKN, propping up the price of TKN. This way the TKN price goes up, and the interest rate for liquidity providers stays high as they are paid in TKN. But the careful reader probably already realized the issue here. The minted Chi is not backed by USD and it goes out in circulation, so someone could decide to redeem it for its supposed value of 1US$ per 1CHI. Really funnily someone even setup a dune page to track the CHI being minted and used to buy TKN

So if we simplify this a bit, basically the money backing CHI is used to pay out the high interest rate and this works as long as enough new people join and not too many leave. Do we have a ponzi here ? You decide.

How bad is it ? Well the people behind chi are funnily actually showing that in their analytics page, you just have to explain what each field really is.

So lets explain what these are, CHI Supply of 42 670 287 is the amount of CHI in existence, some of that are owned by the protocol.

And of today evening compared to morning, theres 4% more, this is rapidly growing.

CHI/USD POL is the USDC+CHI part of the USDC/CHI LP on Tokan that is owned by the protocol. “POL” might be Pool with a typo. This is valid

collateral, the CHI of it can be subtracted from teh CHI Supply and the USDC of it can be used to refund

CHI holders.

CHI In Laas is the CHI part of CHI/ZEN and CHI/TKN LPs on Tokan that is owned by the protocol. This is murky

as a collateral because it only has value if its withdrawn before a bank run happens.

Laas stands for liquidity as a service, in case you wonder.

Volatile and “Over-Collateralization Treasury” are TKN tokens owned by the protocol, they are not usable as collateral, and this is where the real problem starts.

You can look at the “oracle” contract to get these values too and also see from it what each part is.

First, lets pick the best case scenario where we assume the protocol can pull all their assets from the DEX before people try to exit. Also keep in mind that i am using the current values of everything and at another time things will be different.

Here first 31.157M/2(CHI part of the USDC/CHI LP) + 5.478M(CHI of laas) that is 21M of 42.6M are owned by the protocol and we just remove them. Leaving

21.6M CHI owned by users that may want to redeem. The protocol now has the USDC part of their USDC/CHI LP left thats 31.157M/2.

that leaves 6M CHI backed by TKN, while on paper these TKN would have a value of over 37M$. As soon as one starts selling

them, they are going to collapse because basically nothing is backing them, the 2 LAAS positions would be already be

used to reduce the amount that needs to be redeemed. Only about 1M$ remains in eth/tkn that one could use to change tkn into

something of value. So basically In this scenario over 5M$ are missing.

If OTOH the protocol does not pull the LAAS pairs before and they are used by people to trade in their TKN and ZEN into CHI

then the circulating supply of CHI that needs to be redeemed could increase by that amount approaching ~10M $ of missing money.

So ATM basically between a quarter and half of the user owned value behind the chi stable coin seems to not exist anymore.

No, you can have 100 people owning 1 shared US$ and as long as no one takes that 1 US$, everyone can live happy believing they each have 1 US$. Its also possible someone walks up to the box and adds 99$. This is crypto its not impossible someone just pulls 6M$ out of their hat and fixes this hole. But then again, given that the hole becomes bigger every day and the rate by which it grows also grows. I don’t know. I guess ill just hope that all the people are correct, who believe that sticking money into a box will allow everyone to have 66% more each year. Money can be made like that by the central bank or by government bonds or by companies selling a product. But not by wrapping US$ into a funny coin and then providing liquidity between said coin and US$. A coin that seems to have little other use than that.

The key iam using everyday is really becoming old. OTOH the new key iam using for signing my git commits isnt really good as a general key as it needs to be available on the machiene i work on to sign rebased commits and all that. So its more “my git development box” key than mine.

And i have that cute little ledger that has a gpg plugin. So i thought, thats something i should look into. Yeah, or maybe i shouldnt have done that.

It supports ed25519 and cv25519. So i created one and signing worked, decryption failed with a gpg: public key decryption failed: Card error. So i tried again with default options which generates the encryption key apparently on the host backs it up and uploads. That worked fine, it asked for a password to encrypt the backup, signing worked decryption worked, all was fine, or was it? I had set the ledger to require a button before decryption and it didnt. Hmm, i started to have a odd feeling. I disconnected the ledger and tried again, yes it still decrypted it. Was it caching the key or passphrase ? i killed gpg-agent, it still decrypted it. It took me a moment before i fully believed it but yes there was a unencrypted private key where a stub should have been pointing to the ledger.

More testing showed that the ledger works fine with RSA and NISTP256 keys for decryption and RSA and ED25519 for signing. Though it is not able to generate NISTP256 keys, or at least not when i tried, these need to be copied onto. RSA upto 4096 can be generated on the thing if one has patience. CV25519 seems not to work no matter what i tried even though it seems to be supposed to be supported.

Now, i have setup mine (and the public keys are below if you want to send me something secret) but the whole experience leaves me with afterthoughts about wanting to use this. The way this failed and the thing that the source code sometimes speaks of “ed2559” and sometimes of “ed255519” leaves me with some desire for a different device for storing my key on in the long run. Not that any of this is pointing to any real security issues once one got a working key on it and made sure no plain copies remain.

-----BEGIN PGP PUBLIC KEY BLOCK----- mDMEY73h4hYJKwYBBAHaRw8BAQdAsSAAq3LxY0Fcw29nsG39GDF4CMgAoDV8Qb27 aHh2obq0MU1pY2hhZWwgTmllZGVybWF5ZXIgPG1pY2hhZWwta2V5MkBuaWVkZXJt YXllci5jYz6IlgQTFggAPhYhBFwRfsTnHWQ2HRuoQq1G6+FU56XXBQJjveHiAhsD BQkDwmcABQsJCAcCBhUKCQgLAgQWAgMBAh4BAheAAAoJEK1G6+FU56XXPyoBAJTK YelgVZBdkSK0zo4IYqyXR+dUJMjT8SlXvAxsbHVwAP97VsXCcXWxH6oPR/LKGJgA PDO+X5iy6pDFO6eQNmzgA4hdBBMRCAAdFiEEn/ISixR+9nMLrfEzYR7HhwQLD6sF AmO96VUACgkQYR7HhwQLD6uDZQCfTc2K/GL0A6wi5BIGuQMM5iYMX2sAnAvxsZfA bUjviZzbdsuCplgQduG7uFYEY73h4hIIKoZIzj0DAQcCAwS96wJJL1mSdwT94Atc c2Q0r1O4vIkEIqnGDLGXGu3egxWzStCjojpCg+ELEDjU2rxtu51GzYLQUTazEzWU Ql+IAwEIB4h4BBgWCAAgFiEEXBF+xOcdZDYdG6hCrUbr4VTnpdcFAmO94eICGwwA CgkQrUbr4VTnpdflbQD+KCouQqLQ6Gl9bNrPZfXf8055b6qVtfzsQzQF+LOeo4EB AK+6cxLVHB2jcYyvlIv73R8JWvNHcxE/3mDEYKiP3D0J =IkKl -----END PGP PUBLIC KEY BLOCK-----

With the IPFS support in FFmpeg and the discussions surrounding it. Several people stated their dislike for crypto, for NFTs and stated how its harmful and full of scams.

I disagree, Or rather I think people are seeing the “What” today but are missing the “Why” tomorrow.

For me what i see in crypto is giving power over assets back to the people.

Today, everything is a fight of government vs people. Free speech vs censorship. Privacy vs logging and spying. Self defense vs. outlawing tools to defend oneself. And in the future with advances in gene editing control over ones own body will increasingly also get added. But back today and also with money the people are slowly loosing control to the government. Cash is slowly replaced by fully controllable and logable transactions, money printing and taxes are generally fully controlled by the government already. What you can invest in as a “non accredited” investor also is tightly controlled.

Lets look at money printing alone. That on average causes a 50% loss of value in stable currencies like the USD or EUR every 20 years. That means money literally has a half life time of 20 years in stable western economies. And that doesn’t even account for the recent money printing activities of the last years. You may have noticed inflation recently maybe ? Thats the result not of a war its simply because of all the extra money that was created.

Now with crypto, the government has no control over the inflation anymore. Bitcoin might be worth a lot or a little but is not decaying like USD does. And gold even gold inflates as new gold is mined.

And while with cash, any money you own you can give anyone you choose, as cash disappears and is replaced by government controled digital forms of the USD. You also will loose the ability to do with it what you want. OTOH with crypto you can send it to any wallet. And you can set nearly arbitrary rules with smart contracts. It simply returns the power over wealth and assets back into the peoples hands.

I dont know and I don’t really care. Most of the crypto i have originated from payment for a little FFmpeg work very long ago, ive exchanged some of this in other coins and other crypto stuff but i never took it out of crypto and i have no intend to ever.

Theres 2 things about NFTs, the NOW and the Future

NOW, NFTs are used as a way to raise money, many of the bigger projects are shady. Its expected, the more a project promises the more people want it but also the more its all a lie. I would not be surprised if many of these will go to practically 0 value. Then there are the NFTs from honest people who want to start a business and try to use it for getting initial capital some of these pass 100% of the decisions what to do with the collected money to votes by the NFT holders. There are also art and collectible NFTs and a big overlap between all this. I don’t know what will become of all this. The idea to raise money and then have the investors be 100% in control of the business sounds not fundamentally bad to me. Will this survive regulation? I do not know …

And then theres the FUTURE. NFTs can represent anything, a specific car, a specific house, a specific contract you have with an insurance.

In such a world one could sell, buy, exchange and rent houses, cars, contracts in a 100% secure, 100% undisputed and very simple way. Using the “blockchain” to represent all real world assets is an intriguing future, it has interesting potential. I don’t know if that is something that will ever happen but it surely would be a revolution for alot of things.

Powered by WordPress